Colorado Tax Change for Businesses with Out-of-State Owners

If you operate a business in Colorado but the owners live in another state, a recent tax policy change affects you. Previously, Colorado allowed businesses

Summer hours are in effect: Our offices close at NOON on Fridays from May 17th to July 12th

Please Note: Our office will be closed Wednesday, April 16th.

Summer hours are in effect: Our offices close at NOON on Fridays from May 17th to July 12th

Please Note: Our office will be closed Wednesday, April 16th.

If you operate a business in Colorado but the owners live in another state, a recent tax policy change affects you. Previously, Colorado allowed businesses

Colorado Springs, Co. – Stockman Kast Ryan + Co, LLP (SKR+CO), a leading locally-owned certified public accounting firm in Colorado, welcomes three exceptional team members

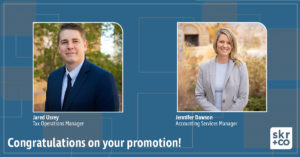

Colorado Springs, Co. – Stockman Kast Ryan + Co, LLP (SKR+CO), one of Colorado’s largest locally-owned certified public accounting firms in Colorado, is proud to announce

Colorado Springs, CO. – Stockman Kast Ryan + Company SKR+CO is delighted to announce that Beth Backora, a valued member of our team, has been honored

Colorado Springs, CO – Stockman Kast Ryan + Company, one of the largest accounting firms in Southern Colorado was recently chosen by Accounting Today as one

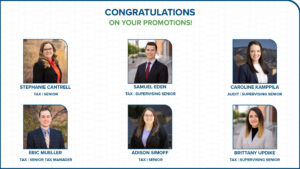

Colorado Springs, CO. – Stockman Kast Ryan + Co, LLP (SKR+CO), the largest locally-owned certified public accounting firm in Southern Colorado, announces recent staff promotions.

Colorado Springs, Co. – Stockman Kast Ryan + Co (SKR+CO), proudly announces the addition of Kyle Hinger, CPA, as the newest member of the SKR+CO

Stockman Kast Ryan + Co to Open Denver Tech Center Location Local accounting firm expands Colorado Springs, Colo. – Stockman Kast Ryan + Co,

We are proud to announce that Stockman Kast Ryan + Company was named one of the top accounting firms in the Mountain Region for 2023

IRS adds Employee Retention Credit claims to its 2023 Dirty Dozen list. The Internal Revenue Service recently announced its annual Dirty Dozen list of tax scams for

Beginning January 1, 2023, meal and entertainment deductions will revert to tax rules under Tax Cuts and Jobs Act (TCJA). These deductions temporarily changed for tax year 2021 and 2022 with the passing of the Consolidated Appropriations Act of 2021. For tax year 2023, many of the meal and entertainment deductions reduce from 100% deductibility to 50% deductibility.

Two major changes from the Inflation Reduction Act include Section 179D building deduction changes and the new direct transfer system. These go into effect January 1, 2023.

Optimize your benefits with the Inflation Reduction Act (IRA) new credits and incentives. Understanding the opportunity of the new direct transfer system The passage of

As the 2021 tax filing season progresses, small businesses and self-employed taxpayers should make certain they are taking advantage of all of the tax deductions

Tax Alert: Tabor Refund Bill passes Senate, awaits Governor’s signature Senate Bill 22-233 passed on May 10, 2022. If signed by the Governor, all eligible

Colorado Springs, Colo. – Stockman Kast Ryan + Co, LLP (SKR+CO), the largest locally-owned certified public accounting firm in Southern Colorado, congratulates Buddy Newton, CPA

Colorado Springs, Colo. – Stockman Kast Ryan + Co, LLP (SKR+CO), the largest locally-owned certified public accounting firm in Southern Colorado, announces staff promotions, photos

Stockman Kast Ryan + Co, LLP (SKR+CO), the largest locally-owned certified public accounting firm in Southern Colorado, congratulates Buddy Newton, CPA , CVA®, as the eleventh member of the SKR+CO partner group.

Stockman Kast Ryan + Co, LLP (SKR+CO), the largest locally-owned certified public accounting firm in Southern Colorado, announces the hiring of Human Resources Generalist Andrew Wilson.

Organizing, filing, and retaining old records is a burden for many businesses, not to mention individuals. As we move into a more “paperless” society, how

The ERC, which was created by the CARES Act on March 27, 2020, is designed to encourage employers (including tax-exempt entities) to keep employees on their payroll and continue providing health benefits during the coronavirus pandemic.