Summer hours are in effect: Our offices close at NOON on Fridays from May 17th to July 12th

Please Note: Our office will be closed Wednesday, April 16th.

Summer hours are in effect: Our offices close at NOON on Fridays from May 17th to July 12th

Please Note: Our office will be closed Wednesday, April 16th.

If you operate a business in Colorado but the owners live in another state, a recent tax policy change affects you. Previously, Colorado allowed businesses choose from three methods to ensure their out-of-state owners paid state taxes. However, starting with the 2024 filing, businesses must take a bigger role in making sure taxes are paid.

How It Worked Before

Businesses had three options to handle taxes for non-resident owners:

Of the three methods, there was no strict rule on which to use. However, Colorado reserved the right to take action against the company if a nonresident owner failed to pay their taxes.

What’s Changing?

Starting in 2024, Colorado now requires businesses to calculate and pay the taxes for their nonresident owners using a composite return—unless you have a DR 107 agreement in place or opt into the SALT Parity Act. Furthermore, the DR 108 Filing option is now eliminated.

What You Need to Do

To avoid completing a composite return, paying tax for nonresidents only, businesses need to:

Pro Tip

With Colorado increasing their scrutiny on nonresident income, you and any new business owners should be proactive about obtaining a signed DR 107 Form. Adding it to your organizational agreements ensures it’s handled upfront, saving you from last-minute tax headaches down the road.

For more information on the DR 107, see the Department of Revenue at https://tax.colorado.gov/DR0107.

IRS adds Employee Retention Credit claims to its 2023 Dirty Dozen list.

The Internal Revenue Service recently announced its annual Dirty Dozen list of tax scams for 2023 with a reminder for taxpayers, businesses and tax professionals to watch out for these schemes throughout the year, not just during tax season.

New on the list in 2023 are Employee Retention Credit (ERC) claims, due to the “aggressive pitches” from scammers who promote large refunds related to the ERC and encourage ineligible people to claim the ERC credit. These promotions are often based on inaccurate information related to eligibility for and computation of the credit.

The ERC is a refundable tax credit designed for businesses who continued paying employees while shutdown due to the COVID-19 pandemic or had significant declines in gross receipts from March 13, 2020 to December 31, 2021. Eligible taxpayers can claim the ERC on an original or amended employment tax return for a period within those dates.

To be eligible for the ERC credit, employers must have:

As a reminder, only recovery startup businesses are eligible for the ERC in the fourth quarter of 2021. Additionally, for any quarter, eligible employers cannot claim the ERC on wages that were reported as payroll costs in obtaining PPP loan forgiveness or that were used to claim certain other tax credits.

Due to the level of ongoing fraud, businesses filing ERC claims may have a heightened risk of an IRS audit. If you filed an ERC claim, it is recommended that you maintain records and documentation that properly demonstrate eligibility. Employers that meet the eligibility criteria and want to file a claim, they have until April 15, 2024 for 2020 quarters and April 15, 2025 for 2021 quarters.

The top twelve schemes that made the 2023 Dirty Dozen list include:

Many of these schemes peak during filing season as people prepare their tax returns. These scams can occur throughout the year as fraudsters look for ways to steal money, personal information, data and more.

“Scammers are coming up with new ways all the time to try to steal information from taxpayers,” said IRS Commissioner Danny Werfel. “People should be wary and avoid sharing sensitive personal data over the phone, email or social media to avoid getting caught up in these scams. And people should always remember to be wary if a tax deal sounds too good to be true.”

If you believe you qualify for the ERC, we highly recommend evaluating the costs and benefits before moving forward with any company. If you have questions about ERC or suspect or are unsure about tax related solicitations, please contact your trusted advisor to clarify.

Barring further action by Congress, many of the TCJA rules are scheduled to expire after 2025 and some may revert to tax rules that were effective in 2017. To learn more, review our chart of meal + entertainment deductions by category and tax year.

Two major changes from the Inflation Reduction Act include Section 179D building deduction changes and the new direct transfer system. These go into effect January 1, 2023.

The Commercial Buildings Energy-Efficiency Tax Deduction (SS179D) provides a deduction of up to $1.88 per square foot for both building owners who construct new or renovate existing energy efficient buildings as well as designers of government-owned buildings. The IRA modifies the tax deduction for energy efficient commercial buildings with new rules for property placed in service Jan 1, 2023. These include:

Additionally, the IRA created two new credit monetization methods: direct pay for tax-exempt entities and full transferability of credits for taxable entities. This change establishes a market for buying and selling tax credits, as well as including all companies to take advantage of clean energy credits.

Click here to learn more about how these two new credit monetization methods can support your company’s sustainability strategy and lower total tax liability.

Optimize your benefits with the Inflation Reduction Act (IRA) new credits and incentives.

The passage of the Inflation Reduction Act (IRA) has created a momentous opportunity for companies to advance clean energy commitments while lightening tax burdens. Signed into law on August 16, the IRA is the largest climate investment legislation in history, allocating $369 billion to clean energy programs over the next 10 years—including many new clean energy credits and incentives for businesses.

One of the law’s most significant changes is the creation of two new credit monetization methods: direct pay for tax-exempt entities and full transferability of credits for taxable entities. The transferability provision effectively creates a market for buying and selling tax credits. The new credit market means that any company, not just energy producers, can take advantage of clean energy credits. For example, a company installing a solar facility on the roof of its building may be eligible for credits that it can use or sell to another company. All companies should consider how these credits can support their sustainability strategy and lower total tax liability.

Other key credits and incentives changes in the IRA include:

In addition, while the IRA also introduces a new 15% corporate alternative minimum tax (AMT) that will take effect in 2023, the IRA’s clean energy credits are among the AMT offsets that are available to affected taxpayers. Corporations that expect their total tax liability to increase due to the new AMT should consider buying credits to mitigate the impact.

Project owners without significant tax liability must decide whether to monetize credits under the new direct transfer rules or use a traditional tax equity structure. Businesses must weigh both options to determine the best path forward for the business and the project.

Direct credit transfers may avoid higher compliance, legal and advisory costs that come with complex tax equity partnership structures but may not allow for the efficient monetization of depreciation. Based on the size and cost of the project, however, there may be an inflection point at which a traditional tax equity structure will yield greater return over a direct transfer. Building a comparative model—either in-house or by working with an advisor—can help a company determine the best structure for its project.

Another consideration concerns the capital structure for new energy projects. When opting for transferring a tax credit, project owners may have to seek additional capital for the initial investment as the credit transaction timing may not occur until the project is nearing commercial operation. To ensure credits can be sold for maximum value, it is critical for sellers of credits to clearly document that the underlying requirements have been met for the credit to achieve the expected value. Companies looking to sell credits should consider working with an independent tax consultant who can certify the underlying requirements, such as prevailing wage and apprenticeship, in a given project have been met to realize the full expected value.

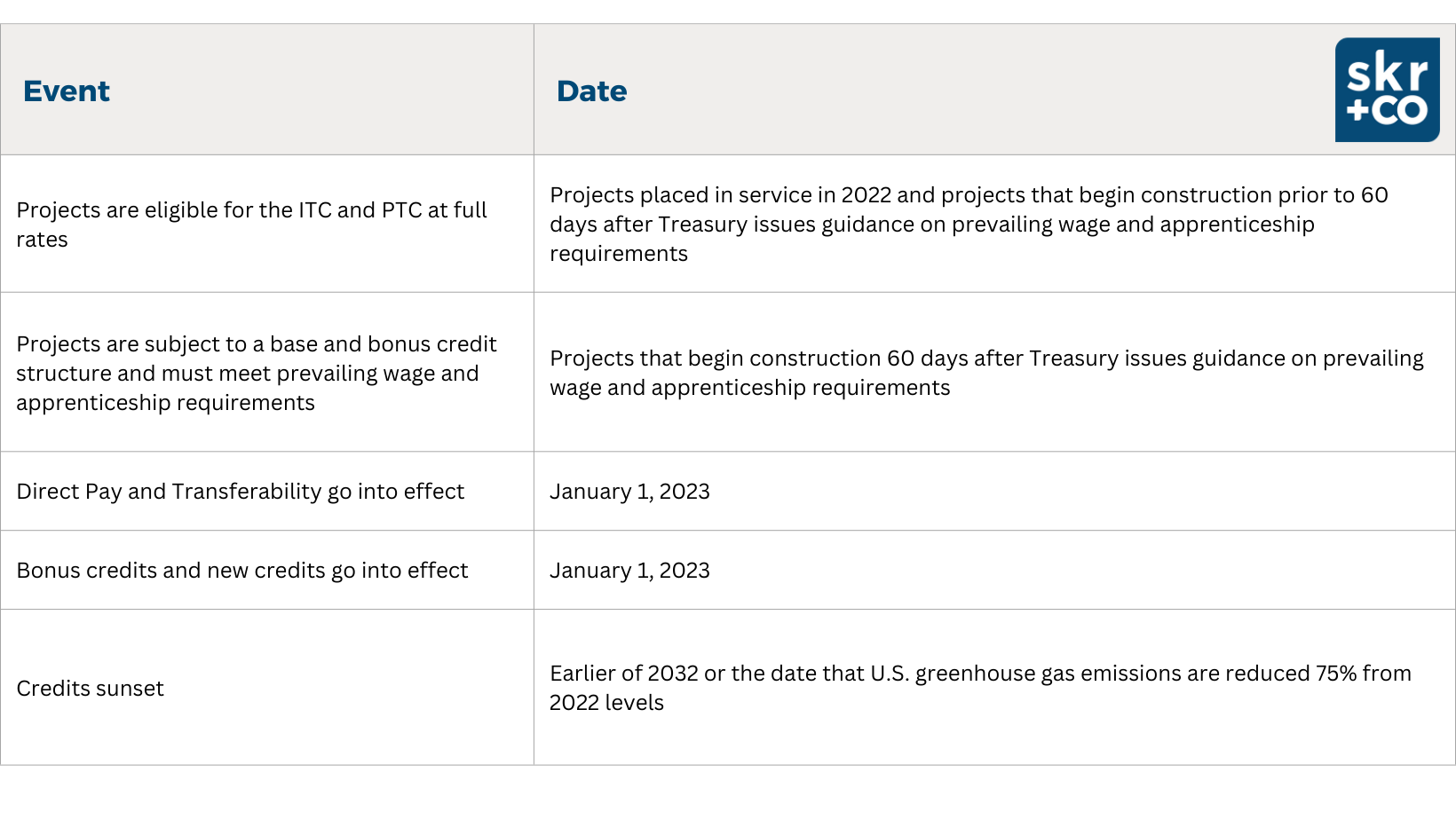

For companies considering a renewable energy project, the time to start construction is now, as projects that are placed in service before year-end, or up to 60 days after the Treasury issues guidance on prevailing wage and apprenticeship requirements, will automatically be eligible for the ITC and PTC at full rates.

While it is still unclear how credits will be valued at the time of sale, the projects that can provide thorough documentation demonstrating credit requirements were achieved will likely transfer at the highest rates.

Buyers should perform due diligence on credit sellers’ projects when purchasing credits to confirm the underlying requirements have been met. A buyer who purchases what it believes is a 30% ITC, for example, should be sure that the bonus requirements were satisfied or else risk the purchased credit being worth less than expected. Buyers also need to determine who will take on the risk of recapture or disallowance if the credit does not meet advertised expectations. As the direct transfer market develops, buyers may seek indemnity clauses as part of the credit transfer agreement. Businesses interested in buying credits should consider working with a tax advisor who can help validate credits, ensuring they meet the advertised value.

Treasury is scheduled to issue additional guidance on the prevailing wage and apprenticeship requirements. Here is a calendar of important upcoming dates to watch:

Written by Michael Stavish. Copyright © 2022 BDO USA, LLP. All rights reserved. www.bdo.com

The full impact of COVID-19 is unknown. While we wait for questions to be answered many are asking what can we do right now? What’s next for our families? What’s next for family businesses and the people who work for them? Planning for our future generations is the greatest gift we can give, particularly during times of uncertainty.

Background

Many closely-held businesses have been impacted by the COVID-19 pandemic, leading to depressed company valuations. The current federal estate, gift, and generation-skipping transfer (GST) tax exemption is $11.58 million per person. That, coupled with the low AFR and Section 7520 rates, provides an opportune time to transfer wealth out of estates without using up exemptions.

Opportunity

There are estate tax planning techniques that can be implemented which transfer the greatest amount of value from an estate while using the least amount of exemption. Transferring assets while they have a low value is a technique that is used to lock-in or freeze those low values in anticipation the asset will one day significantly increase in value. This transfers the appreciation in excess of the frozen value out of the estate with the added benefit of preserving the exemption for additional transfers.

Estate Planning Strategies

GRATS

A grantor retained annuity trust (GRAT) is a powerful technique that allows a transfer of assets to a trust, in exchange for an annuity over a fixed term of years. After the annuity is paid off the assets transferred are owned by the trust for the benefit of the trust beneficiaries, normally the children.

A transaction can be structured to create a “zeroed-out” GRAT, where the annuity is structured in a manner so that the transaction does not produce a taxable gift. The calculation of the GRAT annuity payment is based on the Section 7520 rate in effect at the time of the transfer (for June 2020, the Section 7520 rate is 0.6%), thereby allowing more value to be transferred to the trust without using the exemption.

When transferring assets to the next generation, families are concerned about transferring too much to the younger generation, creating cashflow constraints and transfers that do not use their exemption in an effective manner. The zeroed-out GRAT can achieve financial stability, optimal estate tax results and flexible estate planning options. This simple, effective and time-tested strategy can achieve:

IDGT

An intentionally defective grantor trust (IDGT) is an effective and efficient technique to transfer assets to a trust for future generations. Once the assets are gifted to the trust, they are considered taxable gifts and property of the trust. Those assets can remain in trust for multiple generations, allowing the gift to benefit both children and grandchildren, if desired.

The transaction can be structured as a sale of assets to an IDGT in exchange for a promissory note. This structure is typically an alternative to the aforementioned GRAT. However, this sale is not considered a taxable gift and does not create any gain for income tax purposes. The IDGT promissory note payment is based off the AFR in effect at the time of the transfer (for June 2020, the long-term AFR is 1.01% for promissory note terms longer than nine years), allowing more value to be transferred without using your exemption.

A sale to an IDGT is typically more successful than funding a GRAT as the AFR rate used as the interest rate in the promissory note is generally lower that the Section 7520 rate used to value GRATs. The promissory note can also be structured as an interest-only note with a balloon payment upon maturity, whereas a GRAT must be structured as an annual annuity. Moreover, sales to an IDGT allow for the immediate allocation of GST exemption. With a GRAT, the grantor cannot allocate GST exemption until the end of the GRAT term.

The sale to an IDGT can achieve financial stability, optimal estate tax results, and multigenerational estate planning options. This efficient, effective and time-tested strategy can achieve:

GIFTS

Giving money to a family member in excess of the annual exclusion ($15,000 in 2020) will be a taxable gift. A simple way to provide cash to a family member is to make a loan to them. Historically, if the loan has an interest rate of at least the AFR, the IRS will respect the loan and not claim the transaction to be a gift. With the historically low AFR, cash can be loaned to a family member without creating a burden from charging the family member a high interest rate. June 2020 AFR rates are at historic lows (June 2020 short-term AFR is .18% which applies for terms less than three years, mid-term AFR is 0.43% for terms three years through nine years, and long-term AFR is 1.01% for terms longer than nine years).

The intra-family loan achieves financial stability, optimal estate tax results, and cashflow. This simple, effective and time-tested strategy can achieve:

Planning for the future is not a task to be taken lightly, even in the best of times. During times of uncertainty it becomes even more important. The three estate planning strategies summarized above provide options.

Conclusion: The zeroed-out GRAT is an effective strategy to take advantage of the increased exemption, low Section 7520 rate, and current economic environment. These three factors significantly increase the amount of wealth a family can transfer to the next generation while using a minimal amount of their exemption. Alternatively, a sale to an IDGT can be an effective strategy to transfer wealth to multi-generations and take advantage of the extremely low AFR. Finally, low interest intra-family loans allow families to provide liquidity to various family members without overburdening the family with onerous interest payments.

President Trump is providing support to healthcare providers fighting the COVID-19 pandemic. On March 27, 2020, the President signed the bipartisan CARES Act that provides $100 billion in relief funds to hospitals and other healthcare providers on the front lines of the coronavirus response. This funding will be used to support healthcare-related expenses or lost revenue attributable to COVID-19 and to ensure uninsured Americans can get testing and treatment for COVID-19.

Recognizing the importance of delivering funds in a fast and transparent manner, $30 billion is being distributed immediately – with payments arriving via direct deposit beginning April 10, 2020 – to eligible providers throughout the American healthcare system. These are payments, not loans, to healthcare providers, and will not need to be repaid.

Yes. The CMS Accelerated and Advance Payment Program has delivered billions of dollars to healthcare providers to help ensure providers and suppliers have the resources needed to combat the pandemic. The CMS accelerated and advance payments are a loan that providers must pay back. Read more information from CMS.

All relief payments are being made to providers and according to their tax identification number (TIN). For example:

The Administration is working rapidly on targeted distributions that will focus on providers in areas particularly impacted by the COVID-19 outbreak, rural providers, providers of services with lower shares of Medicare reimbursement or who predominantly serve the Medicaid population, and providers requesting reimbursement for the treatment of uninsured Americans.

The Trump Administration is committed to ensuring that Americans are protected against financial obstacles that might prevent them from getting the testing and treatment they need from COVID-19.

SOURCE: https://www.hhs.gov/provider-relief/index.html; Content created by Assistant Secretary for Public Affairs (ASPA); Content last reviewed on April 13, 2020

| UPDATED 3/19/20, 10:30 a.m. IRS Updates on Tax Payments **Please note: we are planning a client webinar for early next week to explain how the tax deferrals will work. Event details will be posted on our website.** The U.S. Treasury Department and Internal Revenue Service (IRS) issued guidance allowing all individual and other non-corporate tax filers to defer up to $1 million of federal income tax (including self-employment tax) payments due on April 15, 2020, until July 15, 2020, without penalties or interest. To clarify, the federal tax payment deferrals include 2019 tax payments as well as 2020 first quarter estimated federal tax payments. This applies to federal taxes, states taxes vary. Colorado officials said they would mirror IRS guidance as it is updated amid the pandemic. See the American Institute of CPAs (AICPA)’s state-by-state guide for more information. The guidance also allows corporate taxpayers a similar deferment of up to $10 million of federal income tax payments that would be due on April 15, 2020, until July 15, 2020, without penalties or interest. The current guidance does not change the April 15 filing deadline, or the requirement to file for an extension if you do not file by April 15. We anticipate this also may change; however, we are working diligently toward these deadlines. Read the full IRS guidance here. We are monitoring the Treasury Website and the IRS Website for updates and will continue to post the latest information to our Coronavirus Updates page. SKR+CO Document Exchange – New Secure In Person Dropbox: SKR+CO installed a secure dropbox on the 3rd floor of our building. Clients may drop documents off securely, should you prefer to do so in person. Please use an envelope, clips or rubber bands to keep your documents organized. Access to the 4th floor will only be available to SKR+CO essential personnel, effective immediately. USPS mail services, secure email and the client portal are also available to exchange and securely share documents with your CPA. As always, please call your CPA with questions — our receptionist is happy to connect you as we work remotely. |

SKR+CO Client Information:

In an abundance of caution, please avoid unnecessary trips to the SKR+CO office. Instead, we highly encourage:

Sharing documents digitally via the SKR+CO client portal and/or secure email, both located on our client center page.

If possible, please share and/or sign documents electronically via our portal or secure email.

SKR+CO Operations:

Business Recovery Information:

Webinar: We are preparing a webinar for clients regarding business recovery.

Social Media: We will share information placed on our update page through our social media platforms, should you prefer accessing information via those channels.

Business Recovery: Please review the Business Recovery Guide

Additional information from the IRS regarding coronavirus can be found here: https://www.irs.gov/coronavirus

We will list closure status or other updates on our website and our social media channels.

“After the natural disasters in the fall of 2013, the Colorado SBDC disaster relief team worked with federal, state and local resources to produce a comprehensive guide to assist Colorado businesses in preparing for, responding to, and recovering from natural disasters and emergencies.” Click here for the guide . More information can be found on the SBDC Website

Stay up to date with the latest SKR+CO information. Sign up for our newsletter where we will update you with new information as it becomes available to us. You can join our newsletter by signing up at the bottom of our Client Center page.

Are you missing an opportunity to reduce your property tax liability? Nearly all local taxing jurisdictions, including municipalities, counties, and boards of education, generate tax revenue through the imposition of property tax, which is one of the most substantial sources of local government revenue. For many businesses, property tax is the largest state and local tax obligation, and one of the largest regular operating expenses incurred.

Unlike other taxes, property tax assessments are based on the estimated value of the property, and thus, are subject to varying opinions. Businesses that fail to take a proactive approach in managing their property tax obligations may be missing an opportunity to reduce their tax liability.

Below are 10 common property tax myths, and the truths that counter them.

MYTH #1: If a property’s value does not increase year to year, the property tax liability should remain the same.

TRUTH: The annual tax rate is determined by the tax levy necessary to fund the applicable governmental budget for services such as schools, libraries, park districts, fire departments and police. Essentially, the governmental budget is divided by the total assessment within a jurisdiction to calculate the tax rate. The tax rate is applied to a property’s individual assessment to calculate tax. Rates can fluctuate annually and can result in higher or lower taxes even if your property value stays consistent.

MYTH #2: Fair market value is equivalent to assessed value.

TRUTH: Fair market value is an estimate of the price at which property would change hands in an arm’s length transaction. Assessed value is a valuation placed on a property by the assessor, which forms the basis of a property owner’s annual property tax. Assessed value is typically a percentage of the fair market value and takes into account factors such as quality of the property and market conditions. Taxpayers should reconcile jurisdictional ratios in order to understand what is considered the fair market value of their property.

MYTH #3: Property tax bills can be appealed.

TRUTH: Unfortunately, you cannot challenge your property’s value once you receive the tax bill. An appeal must be filed within a set window of time after receiving your assessment notice, which in some cases could be a year prior to receiving the tax bill. If an appeal is not filed during the determined period, a taxpayer would have to wait to appeal until the next year’s assessment.

MYTH #4: Obsolescence adjustments do not apply to newer properties.

TRUTH: Property is typically taxed on a value that takes into account the ordinary diminishment of value occurring because of factors such as physical wear, age, and technological advancements. Obsolescence is an additional form of impairment resulting from internal or external factors affecting value, such as functionality of equipment, processes that inhibit business, or external forces that have impacted financial performance. Regardless of the age of the property, obsolescence factors should be annually reviewed to determine the fair market value of property.

MYTH #5: Assessors establish annual property tax rates.

TRUTH: Property tax rates are set by local governments based on the budget necessary to fund governmental services. Property taxes typically fund city, municipality, county and school district services provided to the community. Assessors determine the value of your property so that the tax burden can be distributed. Assessors do not determine the property tax. The amount of tax payable is calculated by the tax rate applied to your property’s assessed value.

MYTH #6: During a property tax audit, the taxpayer’s role is complete once information is provided to the auditor.

TRUTH: Left alone, auditors can make inaccurate or aggressive decisions. They heavily rely on asset listings and balance sheets to determine if items have been appropriately reported. Taxpayers have a lot to gain by staying in contact with auditors throughout the process. Auditors should know the story that goes with the data. Are all assets on the list physically located on property? Are construction in progress (CIP) assets held on site or at a vendor? Is the supplies balance an annual or year-end balance? In the absence of taxpayer direction, auditors will make assumptions based on limited data. Once audit results are finalized, taxpayers can appeal, but now the burden of proof may have shifted.

MYTH #7: Reducing my property taxes makes me appear to be a bad corporate citizen.

TRUTH: For many businesses, property taxes are their greatest state and local tax burden and, on average, account for approximately 38 percent of the total state and local tax liability. Property owners should ultimately be paying their fair share of property taxes and not more. As property taxes are a cost of doing businesses, certain businesses that overpay may need to make decisions that result in reduced work force or reduced business output. The reductions necessitated by higher tax liabilities may have more negative impact on the community than ensuring that the property taxes remain fair.

MYTH #8: Assessor’s record cards are accurate.

TRUTH: A property record card is a document retained by the assessing jurisdiction that includes assessment information about your property used to determine the value. A property record card includes information such as building dimensions, total land acreage, zoning or use of property, construction detail and other elements to describe the property. Any discrepancies or outdated information may affect the value of your property. Property owners should obtain their property record cards to determine if errors exist that need to be corrected and could result in a lower assessment.

MYTH #9: I pay more property tax in jurisdictions that tax both real and personal property.

TRUTH: Property subject to taxation for property tax purposes can vary by jurisdictions. The tax can be imposed on real estate or personal property. All states tax real property and approximately 38 states tax personal property. Regardless of types of property taxed, the governmental budget will determine amount of tax needed to fund services and the property tax burden will be distributed among taxable values. Therefore, a property owner’s tax liability may be as significant in a jurisdiction that only taxes real property.

MYTH #10: A tenant cannot appeal property taxes. TRUTH: Tenants may have the ability to directly appeal property values in situations where the owner provides written consent or the lease terms allow the tenant to appeal. Property taxes are typically passed through to the tenants, therefore it benefits the tenant to review the annual assessment to determine if an appeal opportunity exists to reduce the property’s assessment

Do you drive a heavy vehicle for work? It could lighten your tax load. If you’re a business owner, your SUV, pickup truck or van may be eligible for 100% first-year bonus depreciation. But it must:

See below for some business vehicles that can do the heavy lifting.

Other rules apply. Contact your trusted advisor for details.